A rate notice may contain some or all of the following rates and charges. Further details on the charges outlined can be found in the adopted Revenue Statement.

Click Here To View Revenue Statement 2024-25(PDF, 9MB)

Click Here To View Rating Category Booklet 2023/24(PDF, 394KB)

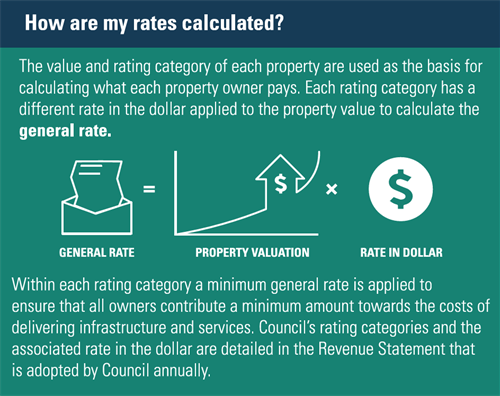

The General rates are issued twice yearly and reflect the cost of services, facilities & activities that are supplied or undertaken for the benefit of the community (rather than an individual person).

Every property within the Western Downs Region is placed into a differential rating category for the purpose of calculating the general rates. Council has determined these rating categories based on the different types of land use and the different levels of services provided.

The Queensland Department of Resources issues the land valuation for each property and this is used to calculate the general rates. The General rate is calculated on each property by multiplying the land valuation by the rate in the dollar for the respective differential rating category. This calculation will be compared to the minimum general rates determined by Council that are applied to each category and the effective general rate will be the higher of the two amounts.

Read the 'How are my Rates Calculated?' Flyer here(PDF, 2MB)

Rates Group 1 - Residential

| Category |

Description |

Rate in $ |

Full Year Minimum

2024-25 |

| 1/1 |

Residential - Localities of Chinchilla, Dalby or Miles |

$0.021150 |

$1,093 |

| 1/2 |

Residential - Localities of Bell, Jandowae, Tara or Wandoan |

$0.014820 |

$982.00 |

| 1/3 |

Residential - Other Localities |

$0.013630 |

$871.00 |

| 1/15 |

Rural Residential - Localities of Chinchilla, Dalby or Miles |

$0.016530 |

$1,093.00 |

| 1/16 |

Rural Residential - Localities of Bell, Jandowae, Tara or Wandoan |

$0.011906 |

$982.00 |

| 1/17 |

Rural Residential - Other Localities |

$0.009678 |

$871.00 |

| 1/20 |

Rural Residential - Colkerri, Hustons Road or Mowbullan |

$0.012212 |

$1,093.00 |

Rates Group 2 - Commercial and Industrial

| Category |

Description |

Rate in $ |

Full Year Minimum

2024-25 |

| 2/1 |

Special Purposes - Localities of Chinchilla, Dalby or Miles |

$0.018116 |

$1,093.00 |

| 2/2 |

Special Purposes - Other Localities |

$0.011236 |

$871.00 |

| 2/5 |

Warehouses and/or Bulk Stores |

$0.021430 |

$4,975.00 |

| 2/15 |

Cotton Gins |

$0.063730 |

$3,862.00 |

| 2/20 |

Petroleum or Other Distilling Plants |

$0.076544 |

$13,821.00

|

| 2/30 |

Transmission/Substation Sites - Less than 1 MVA |

$0.057250 |

$1,990.00 |

| 2/31 |

Transmission/Substation Sites - 1 MVA to less than 10 MVA |

$0.367182 |

$25,045.00 |

| 2/32 |

Transmission/Substation Sites - 10 MVA or Greater |

$0.815040 |

$80,002.00 |

| 2/35 |

Sawmills |

$0.085790 |

$3,862.00 |

| 2/36 |

Noxious Industrial |

$0.068534 |

$18,657.00 |

| 2/40 |

Extractive Industry - Less than 5,001 tonnes |

$0.024726 |

$1,792.00 |

| 2/43 |

Extractive Industry - 5,001 tonnes or Greater |

$0.087572 |

$12,938.00 |

| 2/44 |

Industrial and Commercial Retail Business - Localities of Chinchilla, Dalby or Miles |

$0.026536 |

$1,382.00 |

| 2/45 |

Industrial and Commercial Retail Business - Localities of Bell, Jandowae, Tara or Wandoan |

$0.020952 |

$1,051.00 |

| 2/46 |

Industrial and Commercial Retail Business - Other Localities |

$0.009820 |

$940.00 |

| 2/50 |

Abattoir |

$0.019706 |

$1,774.00 |

| 2/52 |

Hydrogen Production Facility |

$0.096638 |

$69,497.00 |

| 2/77 |

Renewable Energy Generation Facility |

$0.065400 |

$28,750.00 |

| 2/78 |

Multi-Use Renewable Energy Facility |

$0.069604 |

$35,541.00 |

| 2/87 |

Battery Storage Facility |

$0.855170 |

$34,207.00 |

| 2/95 |

Shopping Centres - Less than 5,000 square metres |

$0.027396 |

$46,873.00 |

| 2/96 |

Shopping Centres - 5,000 square metres to less than 10,000 square metres |

$0.036292 |

$104,547.00 |

| 2/97 |

Shopping Centres - Greater than 10,000 square metres |

$0.042726 |

$207,311.00 |

Rates Group 3 - Agricultural Industries

| Category |

Description |

Rate in $ |

Full Year Minimum

2024-25 |

| 3/2 |

Rural |

$0.002676 |

$871.00 |

| 3/10 |

Cattle Feedlot - 501 SCU to 1,000 SCU |

$0.002676 |

$1,483.00 |

| 3/11 |

Cattle Feedlot - 1,001 SCU to 3,000 SCU |

$0.002676 |

$3,702.00 |

| 3/12 |

Cattle Feedlot - 3,001 SCU to 5,000 SCU |

$0.002676 |

$6,517.00 |

| 3/13 |

Cattle Feedlot - 5,001 SCU to 10,000 SCU |

$0.002676 |

$12,188.00 |

| 3/14 |

Cattle Feedlot - 10,001 SCU to 20,000 SCU |

$0.002676 |

$26,123.00 |

| 3/15 |

Cattle Feedlot - 20,001 SCU to 30,000 SCU |

$0.002676 |

$40,429.00 |

| 3/16 |

Cattle Feedlot - 30,001 SCU to 40,000 SCU |

$0.002676 |

$62,193.00 |

| 3/17 |

Cattle Feedlot - 40,001 SCU to 60,000 SCU |

$0.002676 |

$85,516.00 |

| 3/18 |

Cattle Feedlot - 60,001 SCU to 100,000 SCU |

$0.002676 |

$124,384.00 |

| 3/19 |

Cattle Feedlot - Greater than 100,000 SCU |

$0.002676 |

$186,494.00 |

| 3/30 |

Piggery - 2,500 SPU to 5,000 SPU |

$0.002676 |

$1,483.00 |

| 3/31 |

Piggery - 5,001 SPU to 10,000 SPU |

$0.002676 |

$1,925.00 |

| 3/32 |

Piggery - 10,001 SPU to 20,000 SPU |

$0.002676 |

$3,702.00 |

| 3/33 |

Piggery - 20,001 SPU to 50,000 SPU |

$0.002676 |

$11,244.00 |

| 3/34 |

Piggery - 50,001 SPU to 100,000 SPU |

$0.002676 |

$22,488.00 |

| 3/35 |

Piggery - 100,001 SPU to 150,000 SPU |

$0.002676 |

$46,644.00 |

| 3/36 |

Piggery - 150,001 SPU to 200,000 SPU |

$0.002676 |

$62,193.00 |

| 3/37 |

Piggery - 200,001 SPU to 350,000 SPU |

$0.002676 |

$124,384.00 |

| 3/38 |

Piggery - Greater than 350,000 SPU |

$0.002676 |

$186,494.00 |

| 3/40 |

Poultry - Up to 200,000 Birds |

$0.002676 |

$7,740.00 |

| 3/41 |

Poultry - 201,000 Birds or Greater |

$0.002676 |

$11,783.00 |

| 3/50 |

Intensive Animal |

$0.002676 |

$1,553.00 |

| 3/70 |

Land Subject to a Permit to Occupy |

$0.051284 |

$1,045.00 |

Rates Group 4 - Other Intensive Businesses & Industries

| Category |

Description |

Rate in $ |

Full Year Minimum

2024-25 |

| 4/1 |

Petroleum Lease - Gas |

$2.388852 |

$78,554.00 |

| 4/5 |

Petroleum Lease - Petroleum/Shale Crude Oil - Less than 10 wells |

$0.043494 |

$6,332.00 |

| 4/6 |

Petroleum Lease - Petroleum/Shale Crude Oil - 10 to 19 wells |

$1.193266 |

$31,622.00 |

| 4/7 |

Petroleum Lease - Petroleum/Shale Crude Oil - 20 to 29 wells |

$1.351730 |

$104,344.00 |

| 4/8 |

Petroleum Lease - Petroleum/Shale Crude Oil - At least 30 wells |

$1.353316 |

$208,713.00 |

| 4/10 |

Petroleum Other - Less than 400 Hectares |

$0.142850 |

$57,836.00 |

| 4/11 |

Petroleum Other - 400 Hectares or greater |

$0.026750 |

$77,486.00 |

| 4/15 |

Coal Fired Power Station |

$1.407508 |

$626,342.00 |

| 4/20 |

Gas Fired Power Station - Less than 50 Megawatts |

$1.244080 |

$12,028.00 |

| 4/21 |

Gas Fired Power Station - At least 50 Megawatts to less than 200 Megawatts |

$0.409180 |

$116,910.00 |

| 4/22 |

Gas Fired Power Station - 200 Megawatts or Greater |

$5.662216 |

$439,061.00 |

| 4/30 |

Future Coal Mining |

$0.004970 |

$7,301.00 |

| 4/31 |

Coal Mining 0 to 100 employees |

$0.034702 |

$60,092.00 |

| 4/32 |

Coal Mining 101 to 200 employees |

$0.349688 |

$76,637.00 |

| 4/33 |

Coal Mining 201 employees or greater |

$0.588298 |

$103,490.00 |

| 4/35 |

Abandoned Coal Mine |

$0.043688 |

$10,753.00 |

| 4/40 |

Mining Lease (Coal) - 0 to 100 employees |

$0.083756 |

$60,092.00 |

| 4/41 |

Mining Lease (Coal) - 101 to 200 employees |

$0.278978 |

$76,637.00 |

| 4/42 |

Mining Lease (Coal) - 201 employees or greater |

$0.478846 |

$103,490.00 |

| 4/45 |

Mining Lease (Abandoned Coal Mine) |

$0.055000 |

$10,753.00 |

| 4/50 |

Other Mining |

$0.136352 |

$15,008.00 |

| 4/60 |

Mining Lease (Other) - Not greater than 100 Hectares |

$0.027242 |

$1,722.00 |

| 4/61 |

Mining Lease (Other) - 100 Hectares or Greater |

$0.170440 |

$16,043.00 |

| 4/84 |

Workforce Accommodation - 5 to 10 persons |

$0.110546 |

$5,011.00 |

| 4/85 |

Workforce Accommodation - 11 to 100 persons |

$0.221094 |

$18,052.00 |

| 4/86 |

Workforce Accommodation - 101 to 300 persons |

$0.527850 |

$150,437.00 |

| 4/87 |

Workforce Accommodation - 301 to 500 persons |

$0.527850 |

$451,312.00 |

| 4/88 |

Workforce Accommodation - 501 to 900 persons |

$0.527850 |

$551,601.00 |

| 4/89 |

Workforce Accommodation - 901 persons or greater |

$0.527850 |

$952,767.00 |

Council provides a Standard Regional Waste Collection, Recycling & Disposal Service (standard service) to all premises or structures within the boundaries of the declared waste collection service area.

This standard waste service includes one 240L waste bin that is collected weekly as well as one 240L recycling waste bin that is collected fortnightly. This standard service is provided to each premise or structure that appears to be in use as a dwelling, lived in or occupied or able to be lived in within the boundaries of the declared waste collection service areas.

An environmental waste utility charge is levied equally on all ratable properties in commercial, industrial and rural categories, which are not levied a waste collection charge.

These charges cover the costs associated with the collection & disposal of rubbish as well as a contribution to the operational costs of Council's waste management facilities in the region.

|

Regional Waste

Collection Charges

2024/25

|

Category/Charge Description |

Full Year |

| 7/1 |

Waste & Recycling (Regional) Domestic |

$428.80 |

| 7/2 |

Waste & Recycling (Regional) Non-Dom |

$502.60 |

| 120/1 |

Environmental Waste Utility Charge |

$110.80 |

Sewerage Charges

Sewerage utility charges are levied on each property assessment that are in the declared wastewater network area, irrespective of whether the property is connected to the network & to every rateable assessment outside the declared sewerage network but which is connected to Council's sewerage network.

Revenue from these charges is used to assist with the costs of operating, maintaining & managing the sewerage systems.

|

Regional Sewerage

Charges

2024/25

|

Category/Charge Description |

Full Year |

| 100/1 to 100/7 |

Connected Premises (Per Assessment) |

$638.80 |

| 101/1 to 101/7 |

Additional Pedestals |

$546.10 |

| 104/1 to 104/7 |

Unconnected Premises (Per Assessment) |

$493.40 |

| 105/1 |

Intensive Accommodation - Regional |

$638.80 |

Water Charges

Council has adopted a two-part charging methodology, comprising of an access charge as well as a volumetric charge.

An access charge is levied on every rateable assessment within the declared water service area, regardless of whether they are connected to the water network, assessments that are outside the declared water service area but which are connected to the network and to all non-rateable assessments that are connected to the water service network.

Revenue from these charges is used to assist with the costs of operating, maintaining & managing the water network systems.

|

Regional Water

Charges

2024/25

|

Category/Charge

Description

|

Full Year

|

| 200/1 |

Standard Access Charge (20mm or 25mm) |

$516.10 |

| 201/1 |

Standard Access Charge with 100mm Detector |

$855.60 |

| 202/1 |

Standard Access Charge with 150mm Detector |

$990.70 |

| 203/1 |

32mm Access Charge |

$608.10 |

| 204/1 |

32mm Access Charge with 100mm Detector |

$947.60 |

| 205/1 |

32mm Access Charge with 150mm Detector |

$1,082.70 |

| 206/1 |

40mm Access Charge |

$638.80 |

| 207/1 |

40mm Access Charge with 100mm Detector |

$978.60 |

| 208/1 |

40mm Access Charge with 150mm Detector |

$1,113.30 |

| 209/1 |

50mm Access Charge |

$703.90 |

| 210/1 |

50mm Access Charge with 100mm Detector |

$1,043.50 |

| 211/1 |

50mm Access Charge with 150mm Detector |

$1,178.30 |

| 212/1 |

65mm Access Charge |

$709.20 |

| 213/1 |

65mm Access Charge with 100mm Detector |

$1,048.90 |

| 214/1 |

65mm Access Charge with 150mm Detector |

$1,183.90 |

| 215/1 |

80mm Access Charge |

$714.70 |

| 216/1 |

80mm Access Charge with 100mm Detector |

$1,054.30 |

| 217/1 |

80mm Access Charge with 150mm Detector |

$1,189.20 |

| 218/1 |

100mm Access Charge |

$754.40 |

| 219/1 |

100mm Access Charge with 100mm Detector |

$1,094.10 |

| 220/1 |

100mm Access Charge with 150mm Detector |

$1,228.90 |

| 221/1 |

150mm Access Charge |

$1,504.90 |

| 222/1 |

150mm Access Charge with 100mm Detector |

$1,844.50 |

| 223/1 |

150mm Access Charge with 150mm Detector |

$1,979.60 |

Click here for more information

Special charges refer to the rural fire brigade levies, as well as road special charges.

Council levies a rural fire levy on all rateable properties within the rural fire brigade benefited area, to fund the provision of rural firefighting services. The funds collected from this levy is paid in full to the appropriate rural fire brigade.

Road special charges are paid by ratepayers of quarries or coal mines where vehicles used to transport gravel or coal subject roads to excessive wear and tear.

Further information in regards to these charges can be located in the 2024/25 Revenue Statement.

This levy is a State Government levy that is collected via your Council Rates Notice. The levies are paid to the State Government. The purpose of the Emergency Management Levy (EML) is to contribute to the provision of emergency services i.e. fire, ambulance, and disaster services.

Each prescribed property now attracts an EML subject to the following exemptions: adjoining or contiguous lots, under the same ownership, which are used for bona fide primary production, or where a building is built across the adjoining lots.

For further information on the EML, please contact Queensland Fire and Emergency Services on 13 74 68 or visit Queensland Fire & Emergency Services.

Rebates are offered to eligible pensioners and community organisations on rating & utility charges.

Pension Rebate

Eligible pensioners may be entitled to receive a Council concession and a State concession on certain rates and charges. To receive the subsidy, you must:

- Hold either a Queensland Pensioner Concession Card (issued by Centrelink or Department of Veterans' Affairs)

- Department of Veterans' Affairs Heath Card for all conditions (Gold Card)

With this, the ratepayer must also be:

- The owner or life tenant* of the property, which is your principle place of residence & located in Queensland

- Legally responsible for the payment of local council rates & charges levied on the property

*A life tenancy can only be created by a valid will and is effective only after death of the property owner, or by a Supreme or Family Court order.

For a customer to be eligible to receive a pension remission, they must meet the following conditions:

- The address on the pension card must match the property address on Council's records

- The name on the pension card must match the customer's name on Council's records

- PCC Entitlement must show as a yes

Applications for Pensioner Remissions close on the discount date of each period and an Application for Council Rates Remission & State Government Rates Subsidy form needs to be completed with a photocopy of both sides of the pension card to be provided.

Application Rates Pension Remission Form(PDF, 125KB)

Rates & Utilities Concession

The Rates & Utilities Concession is a concession that is granted to eligible not-for-profit (or non-profit) community organisation that are responsible for the payment of rates & utility charges as the owner or leasee of land under the Rates and Utilities Charge Concession for Community Organisation - Council Policy. This acknowledges the valued services provided by organisations and aims to assist with the provision of such services.

Eligible organisations can be granted the nominated concession (expressed as percentages against each concession category) as stated in the Council Policy for general rates, waste utility charges, sewerage charges, water access charges & water consumption charges.

Further information on Council's Rating & Utilities Concession can be found on the Policy link below as well as the Application Forms to be completed by organisations -

Rates & Utility Concession - Council Policy

New Application Rates Utilities Charges Concession Community Organisations(PDF, 220KB)

Renewal Application Rates Utilities Charges Concession Community Organisations(PDF, 206KB)

Each property is placed in a differential rating category for calculating the general rate. Differential rating categories are explained further in the Revenue Statement.

Objection Against Categorisation

If you consider that, as at the date of issue of the rates notice, your land should have been included in another differential rating category, you may object. Objections to categorisation of your land must be lodged with Council on a Notice of Objection Against Categorisation form prior to due date of the relevant rate notice. If received after the due date the category change, if approved, will take effect from the next rating period.

If, as a result of the objection, the subject land is re-categorised, an adjustment of the general rate will be made, and an amended rates notice will be issued. The lodgment of an objection does not confer a right to delay payment of rates. Payment by the due date is a requirement.

For avoidance of doubt, Council delegates to the Chief Executive Officer (CEO) the power (contained in section 81 (4) and (5) of the Local Government Regulation 2012) to identify the rating category to which each parcel of rateable land belongs. In carrying out this task, the CEO may consider, without limitation, Department of Resources (DOR) land use codes, with or without modifications made by Council.

Objection Against Categorisation Form(PDF, 243KB)

Change Address & Receiving Your Correspondence Electronically

Change of Address

It is the responsibility of the property owner to notify Council of any address changes, which you can now complete over the phone.

Please contact Council on 1300 COUNCIL (1300 268 624) or 07 4679 4000 (Interstate callers) to update your address details.

Receiving Your Correspondence Electronically

By switching to electronic billing, you will receive your rates/water/gas notices as a PDF to your nominated email address and you will no longer receive a paper copy by regular post.

To register for email delivery, you simply need to contact Council by phoning 1300 COUNCIL (1300 268 624) and provide a current email address (you cannot register multiple email addresses per property).

Rates Refund or Transfer

If your account is in credit:

If your rates/water/gas accounts are currently in credit, you may request a refund of the credit amount by completing the Request Refund Credit Form. Please note that all accounts with Council must have no outstanding amounts for a refund to be processed.

Request Refund Credit Form(PDF, 366KB)

To transfer credit:

If you need to transfer credit between your rates/water/gas accounts, you can now do so over the phone. Please call Council's Customer Service Team on 1300 268 624 to complete this request. Please note that further documentation may need to be provided for the request to be processed.

Discount & Interest

Discount

A discount of 5% will be allowed on current rates and charges levied (excluding special charges and the State Emergency Management Levy) if all rates arrears (including interest) and current rates and charges are paid in full by the due date printed on the Rates Notice.

Payments received by Council or one of its appointed agents on or before the due date on the specified Rates or Water Notice will attract the discount. For clarification purposes, full payment which is deposited by electronic means to the Council’s bank account or its appointed agents on or before the due date specified on the Notice will attract the discount specified. Discount will not be allowed on payments received after the due date unless Council is satisfied that payment was not made on the due date because of circumstances for which the Council was responsible.

Interest

Interest charges will be applied to all overdue rates or charges pursuant to sections 132 and 133 of the Local Government Regulation 2012, from the day the rates or charges become overdue.

Interest on overdue rates and charges (excluding gas) will be charged at the rate of 12.35% per annum. The rate of interest applicable for the financial year will apply from 1st July 2024. The rate of interest applicable for the financial year will be calculated on daily rests and as compounded interest on all overdue rates or charges (excluding gas).

Council defines an overdue rate or charge as a rate or charge as a rate or charge remaining unpaid after the due date. Interest is applied to overdue account balances thirty (30) days after the due date for payment (this provides approximately a sixty (60) day interest charge exemption in any one year).

Interest does not apply to overdue gas accounts.

A Rates search can be requested by completing the Property Search Request Form, returning to Council and paying the applicable fees.

2023-24 Form: Property Search Request form(PDF, 978KB)

2024-25 Form: Property Search Request form(PDF, 247KB), effective from 1st July 2024.

Payment Options

There are a number of ways to make payments on your rates/water/gas notices, see payment options here.

Please note Council no longer accepts Foreign Cheques.

Payment Plans and Debt Recovery

If you need assistance paying your rates/water/gas:

Council offers many ways we can help you manage your outstanding rates/water/gas debts. Some of these options include:

- paying in weekly, fortnightly and monthly instalments and

- entering into an approved payment plan (you will need a new payment plan upon issue of every new rates/water/gas notice)

Payment plans offer benefits such as the customer being able to choose how often they make payments & no further debt recovery action is taken to recover the debt (as long as you don't miss a payment), however the outstanding balance is subject to interest charges.

To enter into a payment plan, you don't have to complete a form, please contact the Customer Service Team on 1300 268 624 or visit your nearest Customer Service Centre to submit your payment proposal.

Debt Recovery

As part of the Rates and Charges Collection Policy, Council reserves the right to refer the details of any ratepayers that have outstanding rates and charges to a debt collection agency to commence further debt recovery action.

For further information regarding Council's Rates & Charges Collection Policy, please see Rates & Charges Collection Policy 2024/25.

Form Name

|

Form Description

|

|

Authorised Person Financial Information(PDF, 65KB) Form

|

Adding a 3rd party authorisation to an account. |

| Amend Direct Debit(PDF, 347KB) Form |

Requesting changes to an existing Direct Debit -debit amount, frequency, account details, cancel, suspend.

|

| Direct Debit(PDF, 326KB) Form |

Set up a weekly or fortnightly debit to pay Rates, Water, Gas or Accounts Receivable accounts.

|

| Notice Objection Against Categorisation(PDF, 243KB) Form |

Requesting change to rating category due to change to land use. |

Property Search Request(PDF, 978KB) Form* Effective until 30th June 2024

Property Search Request(PDF, 247KB) Form* Effective from 1st July 2024 |

Searches available for purchasing property. |

| Rates Pension Remission(PDF, 125KB) Form |

Pension Concession Card or Gold Card Holder rate rebate. |

| Rates & Utilities Charges Concession Community Organisations(PDF, 220KB) Form |

Not-For-Profit / Community Organisation new application for concession. |

| Rates & Utilities Charges Concession Community Organisations Renewal(PDF, 206KB) Form |

Not-For-Profit / Community Organisation renewal application for concession. |

| Refund Credit(PDF, 366KB) Form |

Account in credit and require a refund. |

Acting upon a development approval can impact upon the rates which are levied against the property, as general rates are calculated based on the differential rating category and the statutory land valuation set by Queensland Government's Department of Resources.

The differential rating category is determined by having regard to the land uses which are occurring on the property. Similarly, the statutory land valuation is determined considering the land's use and zoning under the relevant planning scheme. In some instances, a change of use may result in a significant increase to the general rate which is applied to the property.

Information regarding Council's rating categories and associated charges can be viewed here.

Alternatively, Council's Rates and Charges team can be contacted on 1300 268 624, (07) 4679 4000 if interstate caller, or info@wdrc.qld.gov.au. The team can provide assistance with understanding any consequences of a material change of use on the rating category for the property and any subsequent change to the general rate.

Information regarding statutory land valuations can be viewed here.